ATMs have been part of our environment for such a long time that most of us cannot remember what is abbreviated by these three letters. It is the Automated Teller Machine, where we can take out cash from our bank accounts, without having an appointment in the bank office. We have been using good old ATMs and never expected how much more they could be capable of – if backed up with some innovation.

Quick Project Facts

- Location: Singapore

- Products: Combo Smart Kiosk passport reader

- Key functionality: self-service customer verification

- Year of installation: 2017-2020

ATM vs. VTM

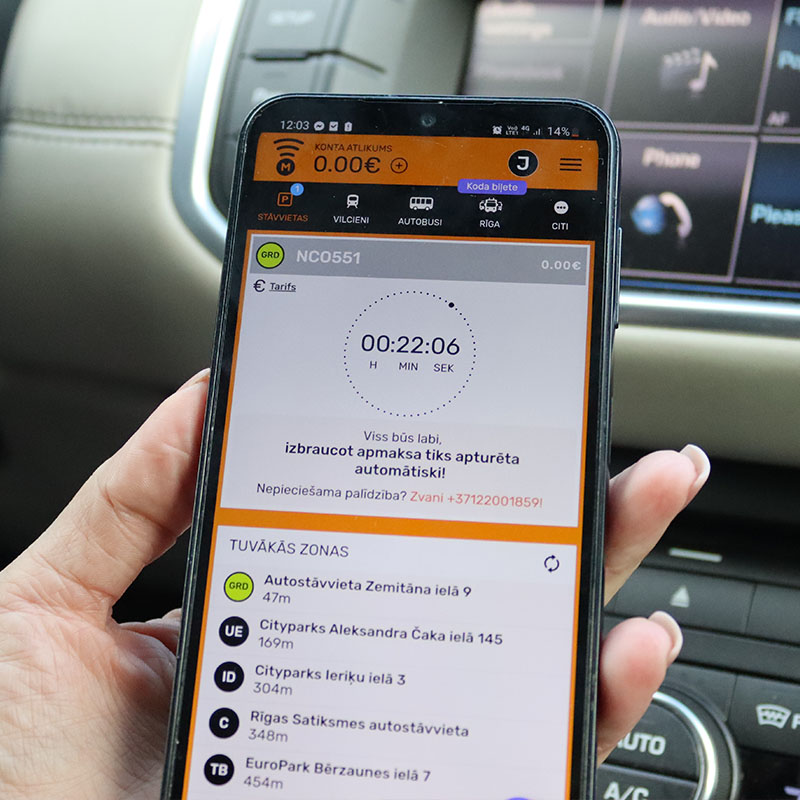

To understand the future of ATMs, let’s define VTM first: it stands for Video Teller Machine – an ATM itself, but a smart one with live video connection, capable of extended functionality.

In addition to the regular ATM functionality, you have all the mentioned extra services, and the only thing needed for getting access is:

- having a video chat

- identifying yourself at the machine

Self-Service Identification: ✓

We come into the picture at the identification phase, as our Combo Smart Kiosk passport readers are integrated into the kiosk. These models are designed especially for built-in usage, offering a super-quick reading and authentication of local IDs and international passports. One of the advantages of such technology is the self-service usage: these scanners perfectly fit in the ATM / VTM procedure as anyone can use them and verify his / her identity within seconds, even without special expertise.

This innovation lets the customers use services:

- without scheduling an appointment

- without waiting in the bank office

- even when the bank is closed.

Cost Efficiency and Customer Convenience: A Win-Win Strategy for Banks

Though it is a great benefit for customers, the bank had multiple motivations when implementing this function: including costs, too. The labor cost and the rent of office spaces are too expensive – and constantly increasing. This is also why the bank wanted to find ways to service their customers better without physically being on the bank premises during office hours. It turned out to be a win-win: an easy service both for the bank and the customers.

Pioneering Innovation: DBS Bank’s Breakthrough and Its Industry-Wide Impact

This technology was first introduced by DBS Bank in Singapore, back in 2017, thanks to the powerful cooperation between Adaptive Recognition Singapore, GRG Banking, and DBS Bank (including POSB Bank).

Since then, the solution has served as a reference point for many financial institutions exploring secure and fully digital onboarding. If your organization is considering a similar step, our team can support you with practical insights and tailored recommendations.

Do you have a similar project in mind?

Sources: