Show more

Read more

View product

View report

Drag

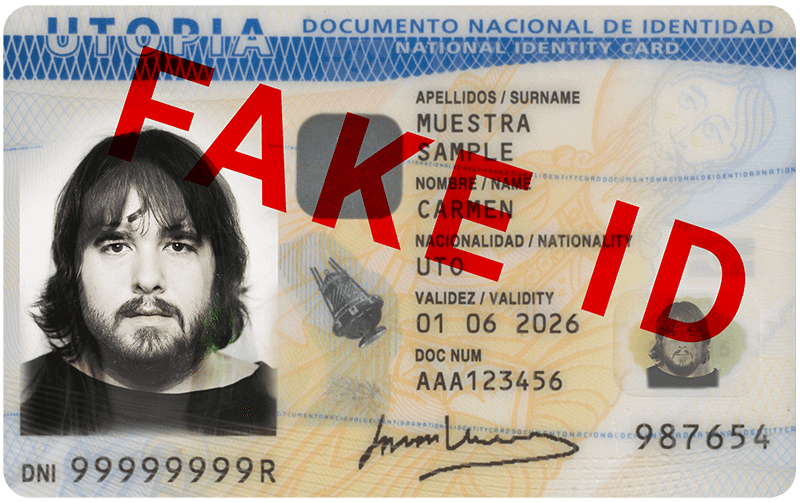

Fraudulent transactions total €1.8 billion annually, often due to weak ID authentication systems. Criminals use fake IDs to exploit banking activities, but advanced technology now offers automated solutions to enhance security and customer experience.

Common issues in banking include unauthorized transactions, inadequate ID checks, untrained staff, privacy risks, slow data input, and outdated customer experiences. Implementing smart ID authentication efficiently addresses these challenges.

Our advanced ID readers are equipped to detect hidden optical security features, playing a vital role in document verification. By leveraging these sophisticated capabilities, we enhance fraud prevention and ensure secure, reliable identification. Our technology provides an added layer of protection against counterfeit documents, safeguarding your operations and ensuring that every authentication process is accurate and secure.

In the banking and finance sector, safeguarding data integrity is crucial. Our state-of-the-art ID readers ensure 100% data security by directly feeding information into your management system, utilizing advanced encryption protocols. This cutting-edge technology not only protects sensitive financial data but also prevents unauthorized access, ensuring that all transactions and personal details are handled with the highest level of security and confidentiality.

For those who chase breakthroughs.

Explore products that push the

boundaries of what you can achieve.

Every industry faces unique obstacles. Discover how Adaptive Recognition can be your partner in tackling them head-on and emerging stronger.

Go beyond the claims, see the proof.

Explore our reference projects and

case studies for tangible evidence of

how Adaptive Recognition delivers

exceptional outcomes